The IRR function stands for Internal Rate of Return in Google Sheets. The IRR function in Google Sheets is basically for calculating financial investments and their returns. It’ll be hard to do a profitable business without knowing the IRR. You can easily calculate your business investment’s expected periodic growth (weekly/monthly/yearly) using IRR.

For instance, you can guess and evaluate business growth by calculating the investment return rate. The rate will come based on your initial investment and your previous income. But, it’ll be hard to figure out these things without applying the IRR function. So, instead of going with a manual process, you can use IRR to avoid trial and error.

In this entire post, I’ll walk you through how you can use the IRR function in Google Sheets. This will help you to know in which you should invest. Remember, the more your IRR rate is, the more your business will make a profit.

An Overview of Google Sheets’ IRR Function

You must have a cash flow for applying the IRR function in your sheets. You can calculate and evaluate the cash flows to see whether your business is making a profit or not.

However, the IRR result is usually compared with the company/business cost of capital. If you find that your IRR result is greater than your cost of capital, then you or your business will make a profit. If not, then vice versa of it will happen.

Here is the syntax of the IRR function: =IRR(cashflow_amounts, [rate_guess])

Let’s get an insight into each part of the function to know what these criteria indicate here:

- = we all know why this sign is for, right? Yes, the equal sign is needed to start any function in Google Sheets.

- The name of the function is IRR.

- cashflow_amounts is the data input of the function. It indicates a range of income or payments based on the investment.

- rate_guess is an optional input that indicates the estimate for what the result will be.

N.B: When you use the IRR function, you need a clear perspective. The perspective dramatically matters for the IRR function to work. Let’s see some examples below-

- When you invest on your own, the cashflow_amounts will represent income, and the value should be positive for sure.

- When the perspective is making a loan repayment, the cashflow_amounts will represent payments, and this time the value should be negative.

- When irregular cash flows return on the investment, using the XIRR function would be perfect instead of IRR.

IRR Function: An Example Using Real Data

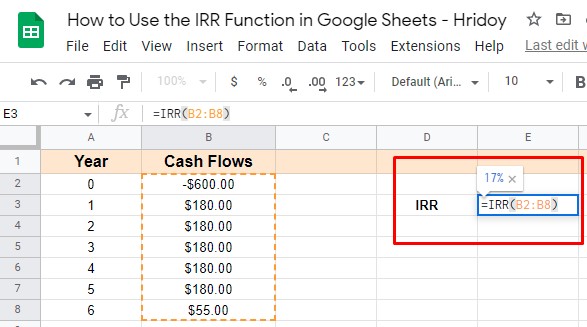

Let’s see an example of how you can use the IRR function in Google Sheets. The below data sheets contain a yearly cash flow (B2:B8). And the rate of return results in cell E3 here.

Based on the datasheet, it only requires the arguments. And the equation of the function here will be-

=IRR(B2:B8)

As you can see, the rate of the return (17%) comes instantly in cell E2. So now, you can say that this above-attached project will make a profit because the rate of the return is more than the initial investment.

How to Use IRR Function in Google Sheets

Well, let me show you the step-by-step process of using the IRR function in Google Sheets.

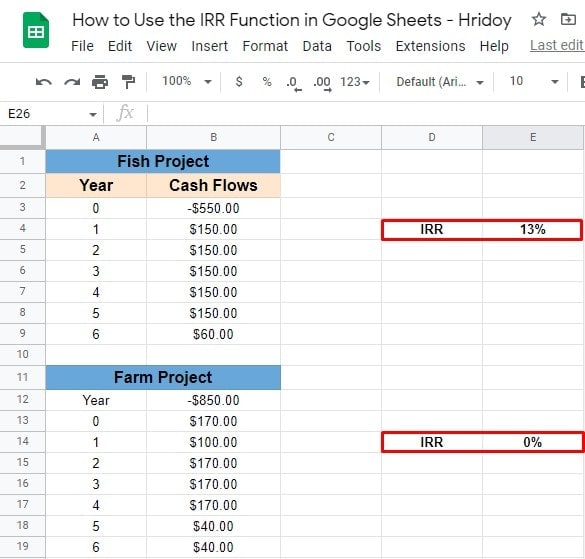

Here, I’ll be comparing two different projects using the IRR function. And will try to show you the difference in terms of the result.

These two projects have different cash flows of cost and profit/loss. It’ll be hard for you to calculate all these at a glace to figure out because of having different costs and cash flows.

However, as I mentioned earlier, the IRR function can be helpful for you in comparing different projects that start at the same time.

The process can be quicker but may not be accurate entirely because it doesn’t consider the cost of capital in its functionality.

So, if you’re the project manager, then it’s all upto you to decide which projects benefit you or your company the most. So, use the IRR function in your cash flow and compare projects easily.

Calculation and Comparison of IRR in Google Sheets

Here’s the step-by-step process below to calculate and compare projects using the IRR function.

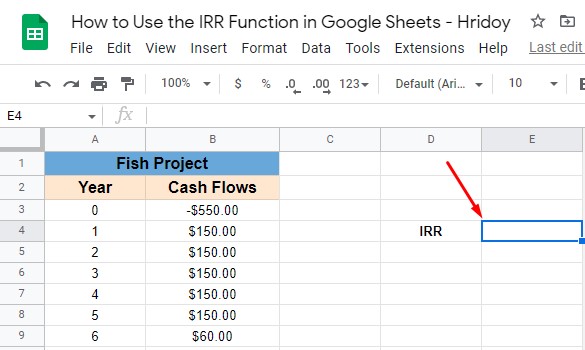

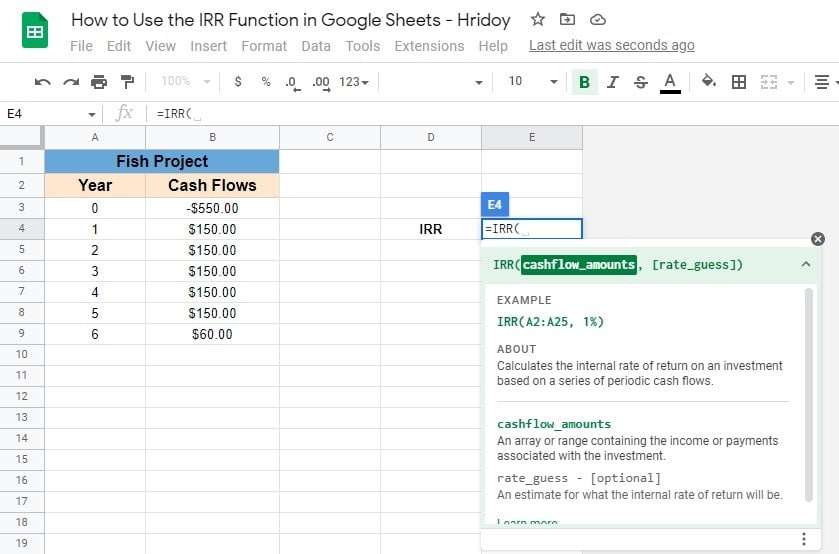

1. Go to your Google Sheets, which contains the data of cash flows. Click on an empty cell to activate it where you would like to have the IRR function. In this guide, I picked cell E4, as you can see below.

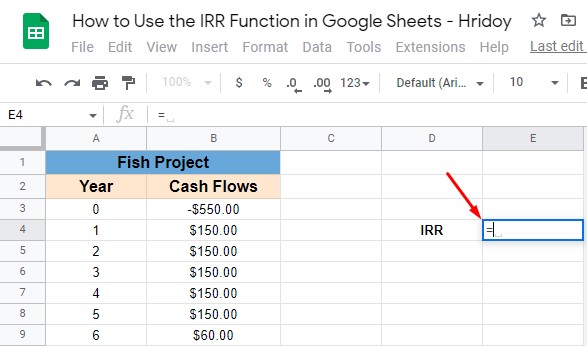

2. Now, type the equal sign ‘=‘ from your keyboard on cell E4. It’ll start the function and then type ‘IRR‘ or ‘irr‘. Both will work because of not having case sensitiveness in Google Sheets functions. So, you can use any of them.

3. Once you type IRR or irr, the function will appear to you with an auto-suggest box. And the box will have a drop-down menu. From the menu, select the IRR function by tapping on it. Make sure that you choose the correct function- the first one from the pop-up list.

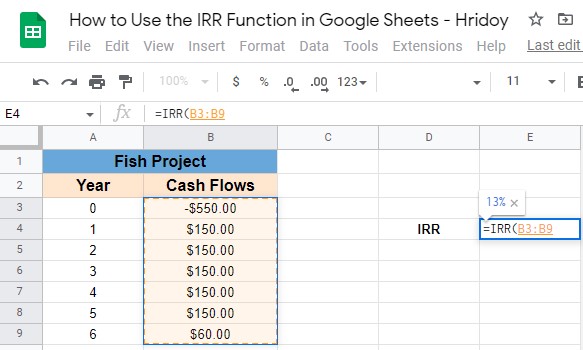

4. When you select the correct function, you’ll have an opening bracket ‘(‘ that indicates you to insert your cash flow range attributes. So, drag your mouse cursor and choose the column range you like.

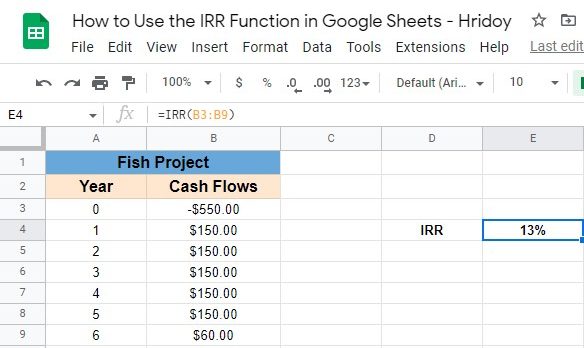

5. When you complete the inputting, you’ll be able to see a preview of your result. Now close the bracket and hit enter! And, here you are with your project’s IRR result eventually.

Follow the same procedure for your other projects and get your internal rate of return result. After that, make your decisions accordingly.

Once you get the IRR result of your projects, it’ll be helpful for you to decide which one you should adhere to and which one you should give up or make progress on.

The IRR Formula: Important Considerations

Use the IRR function to avoid the hassle of adjusting and wild-guessing the values. While applying the IRR function in Google Sheets, you need to remember and follow the below-mentioned things.

- You need to ensure that you have at least one positive and one negative value in your cash flow. Otherwise, your function results with an

#NUM!Error. - The cash flow values in Google Sheets need to be periodic.

- The IRR function doesn’t allow any text or logical value. If it happens, the function will ignore those automatically.

Closing Statement

To wrap things up, I would say the usefulness of the IRR function in Google Sheets in unavoidable. So, if you’re running any company or business, or anything else on which you have invested, and trying to figure out whether you’re making a profit or not, the IRR function is the workaround for you. With it, you can easily calculate the return rate of your investment.

Moreover, you can use this IRR function in your Google Sheets to compare the return rate of different projects. As a result, you can get an insight to decide which one you should stick with and quit others.

I hope you find this helpful. Let me know your feedback in the comment box below, and share this post with others only if you find this worth sharing. Taking a leave for now and will be back very soon. Be with UbuntuPIT, and keep updating your tech knowledge.